1 3 Capitalized interest

Capitalized interest is simply an interest assessment charged against an outstanding principal balance. However, instead of expensing the charge right away, the interest is capitalized as part of the cost of creating a long-term asset. Companies recognize capitalized interest by including it in the cost basis of the asset being generated and depreciating the asset over time. Typical examples of long-term assets for which capitalizing interest is allowed include various production facilities, real estate, and ships. Capitalizing interest is not permitted for inventories that are manufactured repetitively in large quantities. U.S. tax laws also allow the capitalization of interest, which provides a tax deduction in future years through a periodic depreciation expense.

- But a bigger loan balance will affect you in future years—possibly for many years to come.

- In such cases, you would appreciate that the amount of inventory in the balance sheet increases by the amount, which is deducted from P&L under “Increase in inventory”.

- Find out if you could benefit from changes to how payments are counted toward forgiveness.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- If an entity has incurred interest costs higher than a given level, the excess can be claimed within the tax base of subsequent periods.

Extending the number of years to complete the degree will result in higher amounts of interest capitalized — added to the principle balance — of the loan. This will significantly increase the principle balance, thereby increasing the future interest payments for the loans. One the student starts repayment, the payments typically go against current interest and then capitalized interest. The original principle balance will not reduce until the capitalized interest portion is fully repaid. Businesses do not typically face this problem because they often have more money to repay the loan more quickly than individuals.

Would you prefer to work with a financial professional remotely or in-person?

When you take out student loans, your lender may capitalize interest costs at the end of a deferment or forbearance. Instead of paying the interest as it comes due, you can let costs build up. Because the interest charges go unpaid, the charges get added to your loan balance.

The cost basis of a loan increases over time because future owed interest is charged interest as well. This is why a mortgage cost is sometimes double the actual amount borrowed, even though the interest rate was quite low. When you look at a mortgage table of payments over a 30-year period, you can see that the total paid on the loan continues to increase over time. This is why many borrowers try to pay down loans with additional principal payments to reduce the compound factor of the loan. If the principal balance drops, the amount of interest and compound interest is based on a lesser value. You also have the option to instruct us to not advance your due date more than one month, as a one-time or recurring special payment instruction.

Secretary of Defense, to order you to state active duty, and the activities of the National Guard are paid for with federal funds. If you plan to pursue Public Service Loan Forgiveness, visit StudentAid.ed.gov/PublicService for information about prepayments and how a paid-ahead status impacts qualifying payments. If you plan to pursue Public Service Loan Forgiveness for Direct Loans, visit StudentAid.gov/PublicService for company might be capitalizing the interest cost meaning more information about prepayments and how a paid-ahead status impacts qualifying payments. Yes, you have the option to request your payments be allocated differently than the standard payment allocation method, as a one-time or recurring special payment instruction. New one-time student loan cancellation to be granted based on income. You can view updates at StudentAid.gov/debt-relief-announcement/one-time-cancellation.

thoughts on “Understanding Capitalization of Interest & Other Expenses”

It might be called capital interest, interest expense or amortized deferred financing. Loan statements won’t tell you what capitalized interest is in a clear-cut fashion. A good bookkeeper or accountant categorizes any new loan in the company books as a debt and should establish the parameters of payment.

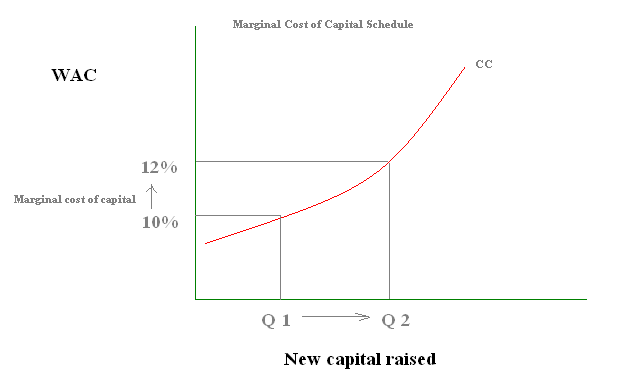

The primary purpose of capitalized interest is to increase the amount of debt financing available to a company. This can benefit a company because it can allow it to finance more projects or expand its business. Capitalizing interest increases the loan amount and the interest amount over a long period improving finances for the company.

Tax Disadvantages of Capitalizing Interest

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Interest of $12,981,000 and $2,106,000 was capitalized during 2018 and 2017, increasing earnings per share by 25% and 4%, respectively. The amortization of interest capitalized in prior years did not significantly affect income for the periods. The effect of capitalization is to present higher reported earnings during the period of construction. This is achieved by not expensing part of the interest cost and lowering earnings in later years through higher depreciation.

If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.S.C. Chapter 71. Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards.

What is the approximate value of your cash savings and other investments?

During our audit practise, we encounter cases where companies address the potential negative tax implications of financing their investment and operating needs. This idea led us to summarize the possible procedures and pitfalls of this issue. Compound interest is more complex because it is the total principal and interest in the future less the principal amount at present. Keep in mind that compound interest could be compounded daily, monthly, quarterly or annually. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

It is clear from the Accounting Act that only related interest to the acquisition cost of the asset can be capitalized. There may be situations in which an entity decides to use the tax capitalization instrument to optimize its tax base. The entity will therefore develop efforts to capitalize as much of its interest costs as it is unable to classify as tax-deductible.

Benefiting from Trade Shows: How to Make the Most of them During … – Small Business Trends

Benefiting from Trade Shows: How to Make the Most of them During ….

Posted: Thu, 03 Aug 2023 10:16:45 GMT [source]

Paying interest on top of interest is a form of compounding, but it works out in your lender’s favor—not yours. Depreciation expense is a pretax cost that reduces the profit of a company without reducing its cash flow. In accordance with the matching principle, capitalizing interest ties the costs of a long-term asset to the earnings generated by the same asset over its useful life. The downside is that while investors provide essential funding, they also gain important rights.

The Differences Between Interest Coverage Ratio & Fixed-Assets- to Long-Term-Liabilities Ratio

Interest must be capitalized until the date the asset is placed in service. Once this occurs, a company should add back any previously capitalized interest to net income so they can get a more accurate picture of their earnings. If a company does not add back the interest, it can be very misleading to investors.

Capitalized Interest: Definition and Example – Investopedia

Capitalized Interest: Definition and Example.

Posted: Tue, 02 May 2023 07:00:00 GMT [source]

Capitalization of borrowing costs terminates when an entity has substantially completed all activities needed to prepare the asset for its intended use. Substantial completion is assumed to have occurred when physical construction is complete; work on minor modifications will not extend the capitalization period. If the entity is constructing multiple parts of a project and it can use some parts while construction continues on other parts, then it should stop capitalization of borrowing costs on those parts that it completes. However, the specific treatment of accrued interest does not always prevail itself to being capitalized. For example, a missed payment of interest could simply be a period expense that is immediately recognized on the income statement.

Something to consider when capitalizing your business is the opportunity to capitalize interest. This refers to the interest you pay on loans to finance your long-term assets. When you capitalize interest, you add the cost of the interest to the book value of the long-term asset.

- We need to understand it by combining both the balance sheet (B/S) and the profit and loss (P&L) statement.

- There may be situations in which an entity decides to use the tax capitalization instrument to optimize its tax base.

- Frequent cases occur where the deferred maturity of principal and related cumulative interest is determined.

- The step to be followed include establishing the period, interest calculation, and then the capitalized interest.

- As can be seen, capitalizing the interest once at repayment increases the total cost of the loan by $1,571.96, as compared with paying the interest during the in-school and grace periods.

You can log in to your Nelnet.com account to view your accrued interest on the My Loans dashboard card. The main difference between the two is that interest is the cost incurred by an individual after borrowing a certain amount of money. In contrast, capitalized interest is a type of interest that is usually added to the principal amount of the loan. Your lender can provide information about how much interest is charged to your account each month. Doing so puts you in a better position for the inevitable day when you have to start making larger amortizing monthly payments that pay down your debt.

Direct Consolidation loans comprised of any FFEL or Perkins loans not held by ED are eligible for debt relief, as long as the borrower applied for consolidation before September 29, 2022. Once you reach your home page, review the following items to get ready for repayment. At any time prior to submitting your electronic signature, you may opt out of the electronic signature process and continue with a paper process. Simply exit this session prior to accepting this Electronic Signature Agreement.

This is important, especially if the business is looking for new investors or has a board of directors filled with parties of significant influence, perhaps even a majority interest in the company. A well-established company should have the pieces of the puzzle worked out so revenues are consistent. If a company has 1 million shares, the majority shareholder interest is the party or strategic alliance with 500,001 shares. This shareholder equity is also listed on the company’s balance sheet as “paid-in capital,” and may be broken down into line items such as preferred stock and common stock. It also includes retained earnings and treasury stock that is still owned by the company and not a shareholder.

The total amount of interest paid by a company would be visible in the cash flow statement under cash flow from financing (CFF). However, she must keep in mind that many companies show capitalized interest as a part of an increase in fixed assets under cash flow from investing activity. You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run. If you are not required to make a payment this month, you won’t be considered past due if you don’t make a payment or pay less than your regular monthly payment amount. However, we encourage you to continue paying as much as you can even if your current amount due is $0 because interest may continue to accrue on your outstanding principal balance.