If you are a loyal Apple fan, you might have been overjoyed when Apple launched its Apple Card service. Now, the question is whether it has made any noticeable change in the way we do things. This card is issued by Goldman Sachs and the best rewards are given for Apple purchases and transactions made via Apple Pay. This is just the right time for this release, considering Google’s expansion of Google Pay. Since the fees are not very high, it is a good enough addition to the Apple Wallet. To put it simply, it is great for use with Apple purchases, but outside of that, you would be better off other cards. Let’s take a look at some of the pros and cons of Apple Pay.

Apple Card Features

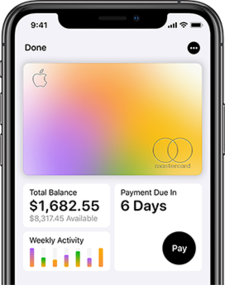

Before we get into the nitty-gritty of the good and the bad points of Apple Card, let’s first see what it offers. It has cool tools that could help you budget your spending and learn more about how interest and other factors work. The credit card debt tools show the users how the money they pay impacts the interest.

Trusting Apple, we assume that they must have a good customer care team in place. However, since this is Goldman Sachs’ first credit card, we cannot be so sure. You will also not receive a free credit score – something which most others in the market offer.

Benefits of Apple Card

If you are indulging in Apple purchases, you will receive excellent rewards and benefits and in most cases, better than others in the market. For non-Apple purchases, users will receive a 3% Daily Cash rate on certain buys. For instance, this includes Walgreens, T-Mobile, Uber, and UberEats. As many as 74 of the top 100 U.S retailers accept Apple Pay. This list is increasing all the time. Apple has also made an effort to bring interactive features to credit card statements that would help users understand various aspects of their spending, such as payment, credit card interest, and more. It also has one of the relatively lowest APR in the market.

Drawbacks of Apple Card

While it does offer great benefits, it is only worth the value for ardent Apple users. Since the card’s value comes from Apple Pay, users cannot make use of it without an Apple device. The rewards rate on non-Apple purchases are so low that using it does not make any sense. While it may look trendy, there is no real value attached to them. It could offer more features and sign-up benefits like other financial tools. The glaring lack of them makes it not a good idea.

Security

Apple can be truly trusted regarding security. For better security, the company has come up with a new design. The Apple Cards, both physical and digital, don’t have any numbers on them. If you are using your card for a non-Apple Pay transaction, the Wallet App or the Safari browser will automatically fill in a number. Another cool feature is that you can now click on a specific transaction and see where it occurred thanks to integrated map data. This is perfect if you don’t remember a particular purchase.