Money is god for everyone and earning more and more money is the dream of everyone. We all want to save money and have control over our expenses but not all can do. This is of course not an easy task it takes a lot of effort to hold what is yours.

If you are at the stage that you are going to retire or in your student life or even these apps put a halt on your expenses. Many times this happens with us that we do not realize and we just keep on spending money! With the help of these apps, you can at least control over 50 percent on your money and how you spend it.

The advantages of having money saving apps –

When it comes to the app we have several options but what is best for us and what is not. This makes everything difficult very easy.

- It will constantly remind you about your expenses.

- Remind you and warn you about your money

- Help you in controlling over expenses

- Keeps details of every day

- A good and well-managed account.

My Budget Book

This app offers personal financial budgeting and tracking as this is the primary feature that helps consumers in saving money each day. The app gives direct guidance on the bearing on those $100 jeans and this would household budget.

My budget book has a different way of offering the same thing whether it comes about authentication or saving money. As money is not a small thing it matters for everyone. Here this app allows you to use its features for free and keep details about your account and even save money.

The app has even direct guidelines to give you for impact and guidelines in spending or saving your money. This app can be found in ten different languages (highlight of the app) which means it is giving comfort and ease to the people.

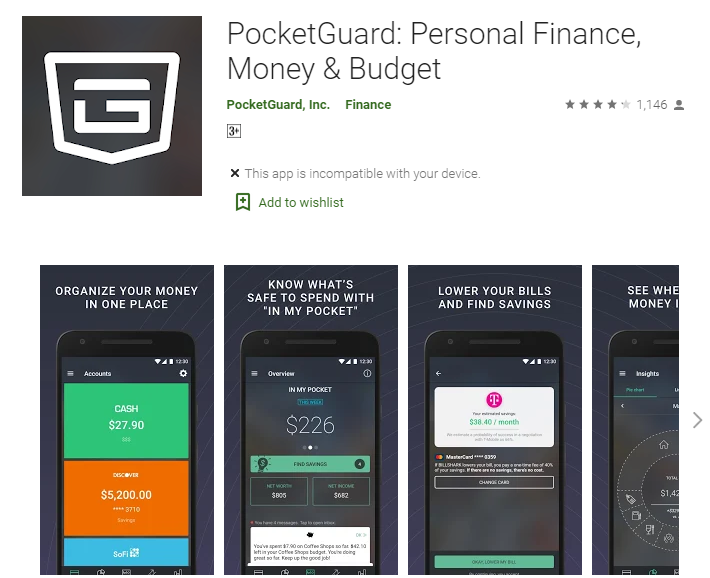

PocketGuard

It is also a personal finance app that takes a straightforward and almost simplistic approach if you want to balance your personal money. In this app, you will have to create an account, sync that along with your bank account.

You can check on your PocketGuard this will inform all about your everyday bills which gives you a ‘What left in your pocket’ or what is left. This even adds your personal net worth and net income which helps in finding savings such as credit cards, home mortgages and insurance.

The basic PocketGuard is even free but you may even pay $4 a month for the PocketGuard plus, this even offers advanced features such as ‘pockets’. Plus the potential of tracking the cash on a real-time basis.

Qapital

This app has especially been designed for financial consumers to save cash. If talking about this app it is more a banking app and the best part about it is that you can get it for free. The app informs about your regular purchases on a real-time basis.

Qapital even offers saving options that anyone can reroute cash into your Qapital savings account. there are many customers who are worried about the authentication of the app. feels happy announcing about the app that it is being protected by the FDIC (just as the regular bank savings account).

Acorns

Acorn is unique in its way because of the feature it is giving. This one is not really geared towards budgeting and savings but the app is a great help. The app has been designed with the great help of the famed Wall Street investor Harry Markowitz. There is even a tiny $ 1 fee for the accounts with less than $5, 000. There is even a $2 monthly fee for the individual retirement account. The rating of this app is even good.

Mint

![]()

this app can be a great help as this even sends you a reminder or warning about your budgets and expenses. It is surely based on your habits, and this even offers you particular advice in gaining more control over your spending. There have even special features of rendering your real-time credit score.

YNAB

It stands for you need a budget and this app stands different from the line. It halts one from stopping living paycheck to paycheck, pays down debt and roll with the punches.

With this app, you will be able in setting your weekly and monthly budget chart (all personal finance apps do) but you can even set up the budgets for the individual projects such as New Year gifts and all. This has its own feature which is of course quite impressive and helpful in what you are seeking.

Credit karma

did you hear about this ever or not? Yes then it is very good or if not then you must. The app helps in accessing your credit report as to when we own credit cards we forget we still have limited money over there.

This app has free services by offering targeted ads which will be based on your credit card. Comparing this app with others then this has its own individuality which cannot be compared.

Winding-up

This becomes necessary to keep eye on your own habits and actions otherwise you might lose so many things. Because this usually happens with us that we spend a lot of money without paying attention to our actions. We just keep on spending money without noticing where we should spend and where we should control our habits.

So from the above list, you may go for your own comfortable app which is surely a big help to you and will help you in every way. Every app has a different feature but all of them are very authentic and good for the purpose you are looking for.

Therefore, just go and download anyone from them and just use that without paying a single penny and save money for a better future and living your dreams.